Strategies for Cost-Effective Offshore Firm Development

When taking into consideration offshore company formation, the pursuit for cost-effectiveness becomes a paramount problem for companies looking for to increase their operations globally. In a landscape where monetary carefulness rules supreme, the techniques used in structuring offshore entities can make all the difference in accomplishing financial effectiveness and functional success. From browsing the complexities of territory selection to executing tax-efficient frameworks, the journey in the direction of developing an overseas presence is swarming with obstacles and opportunities. By exploring nuanced methods that mix lawful compliance, economic optimization, and technical innovations, businesses can start a course in the direction of overseas firm formation that is both financially prudent and tactically audio.

Selecting the Right Jurisdiction

When developing an overseas company, selecting the appropriate jurisdiction is a critical decision that can considerably impact the success and cost-effectiveness of the development process. The jurisdiction chosen will certainly establish the regulative structure within which the business operates, influencing tax, reporting requirements, privacy regulations, and general service adaptability.

When selecting a jurisdiction for your overseas business, several factors have to be thought about to guarantee the decision straightens with your calculated objectives. One critical facet is the tax obligation regimen of the territory, as it can have a substantial influence on the business's productivity. Furthermore, the level of regulatory compliance called for, the political and economic stability of the territory, and the ease of operating should all be evaluated.

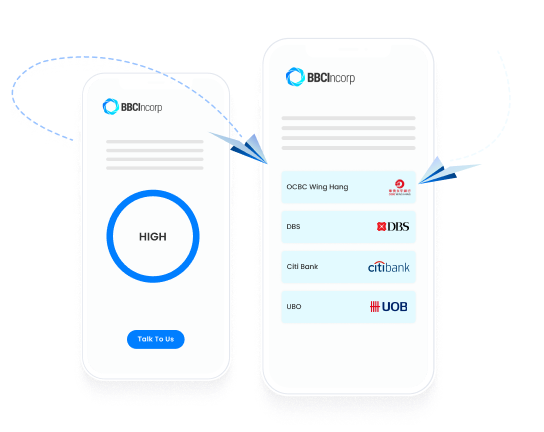

Additionally, the reputation of the jurisdiction in the international company area is important, as it can influence the perception of your company by customers, partners, and financial organizations - offshore company formation. By carefully evaluating these elements and looking for professional recommendations, you can pick the appropriate jurisdiction for your offshore company that enhances cost-effectiveness and sustains your business objectives

Structuring Your Firm Effectively

To guarantee optimum effectiveness in structuring your offshore firm, precise attention has to be given to the organizational framework. By developing a clear ownership structure, you can guarantee smooth decision-making processes and clear lines of authority within the firm.

Following, it is important to think about the tax obligation implications of the selected structure. Different jurisdictions supply varying tax benefits and incentives for offshore business. By very carefully assessing the tax regulations and laws of the chosen territory, you can maximize your business's tax obligation performance and decrease unneeded expenditures.

Furthermore, maintaining proper documents and records is important for the effective structuring of your overseas company. By maintaining accurate and current documents of financial deals, corporate decisions, and conformity records, you can check this make certain openness and responsibility within the organization. This not only facilitates smooth procedures however likewise assists in demonstrating conformity with governing demands.

Leveraging Innovation for Cost Savings

Effective structuring of your overseas business not only pivots on meticulous attention to organizational structures but also on leveraging innovation for cost savings. One method to leverage technology for savings in offshore company formation is by using cloud-based solutions for information storage space and cooperation. By integrating technology strategically into your offshore firm development procedure, you can accomplish considerable savings while enhancing operational effectiveness.

Minimizing Tax Obligation Responsibilities

Utilizing strategic tax obligation preparation techniques can efficiently decrease the financial concern of tax obligation obligations for offshore companies. One of one of the most typical methods for minimizing tax obligation liabilities is through earnings moving. By dispersing profits to entities in low-tax territories, overseas companies can legally reduce their overall tax obligation responsibilities. Furthermore, taking advantage of tax incentives and exceptions used by the territory where the offshore company is signed up can lead to considerable savings.

One more approach to lessening tax obligation responsibilities is by structuring the overseas company in a tax-efficient way - offshore company formation. This involves meticulously making the ownership and functional framework to optimize tax advantages. As an example, setting up a holding firm in a jurisdiction with beneficial tax obligation laws can assist lessen and settle profits tax obligation exposure.

Additionally, remaining upgraded on international tax obligation laws visit here and compliance requirements is crucial for lowering tax liabilities. By guaranteeing stringent adherence to tax legislations and guidelines, overseas firms can prevent pricey fines and tax obligation disputes. Seeking professional advice from tax specialists or legal specialists focused on worldwide tax matters can likewise provide important insights into efficient tax planning strategies.

Making Certain Compliance and Threat Reduction

Carrying out robust compliance actions find more is essential for offshore firms to reduce dangers and keep regulative adherence. To make certain compliance and alleviate dangers, offshore business need to conduct comprehensive due diligence on clients and service companions to prevent participation in illicit activities.

In addition, staying abreast of transforming policies and lawful needs is important for overseas business to adjust their conformity practices accordingly. Involving legal experts or compliance experts can offer valuable guidance on navigating complicated governing landscapes and making certain adherence to global standards. By prioritizing compliance and threat mitigation, offshore companies can enhance openness, build count on with stakeholders, and protect their operations from prospective legal consequences.

Final Thought

Utilizing critical tax planning techniques can successfully minimize the monetary worry of tax obligation liabilities for offshore firms. By distributing revenues to entities in low-tax jurisdictions, offshore business can legally reduce their general tax obligation responsibilities. Furthermore, taking benefit of tax incentives and exemptions offered by the territory where the overseas firm is signed up can result in significant financial savings.

By making certain strict adherence to tax laws and regulations, overseas business can prevent expensive charges and tax disputes.In final thought, cost-effective overseas business development needs cautious consideration of jurisdiction, reliable structuring, modern technology usage, tax minimization, and conformity.